The Ultimate Guide To Home Warranty Claim

Wiki Article

Unknown Facts About Home Warranty Claim

Table of ContentsAn Unbiased View of Home Warranty ClaimThe 7-Second Trick For Home Warranty ClaimWhat Does Home Warranty Claim Mean?Home Warranty Claim Fundamentals ExplainedThe 30-Second Trick For Home Warranty ClaimAbout Home Warranty Claim

Residence insurance policy might additionally cover clinical expenses for injuries that individuals suffered by being on your residential or commercial property. A house owner pays a yearly costs to their home owner's insurance provider. Typically, this is someplace between $300-$1,000 a year, relying on the plan. When something is damaged by a catastrophe that is covered under the home insurance coverage, a house owner will call their home insurer to sue.

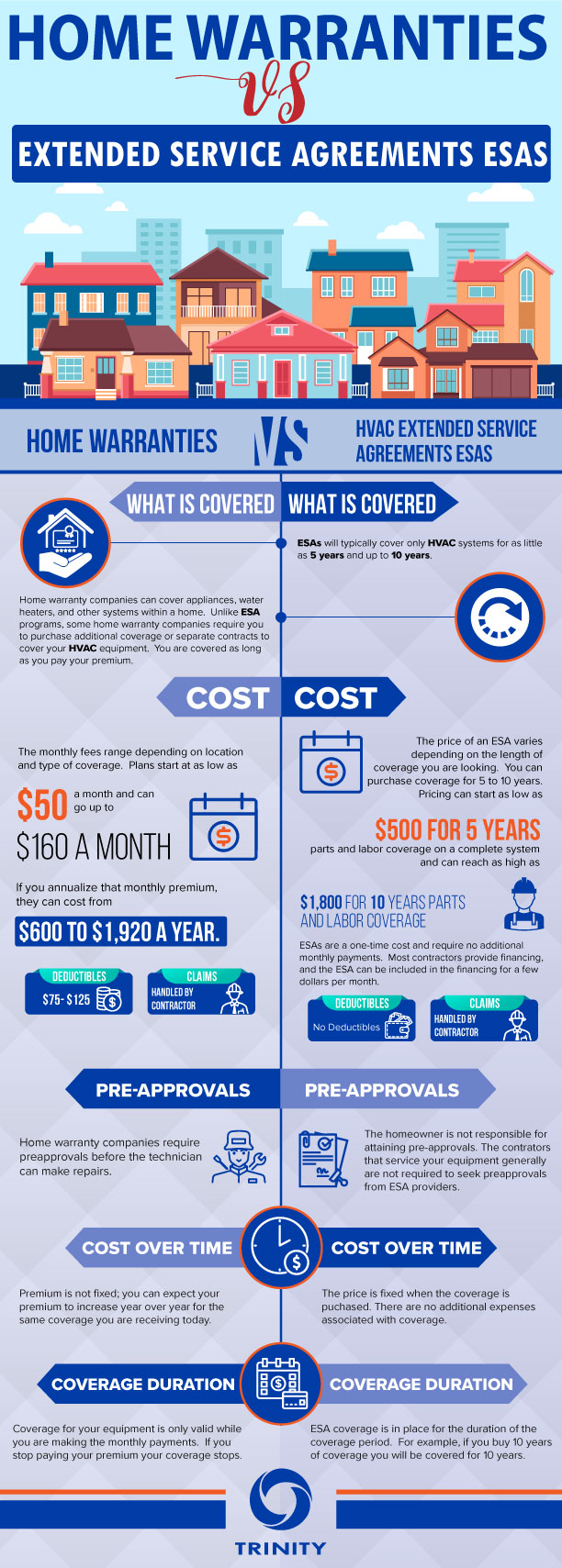

What is the Difference Between Home Guarantee and also House Insurance A home warranty contract and a home insurance plan run in similar means. Both have a yearly premium and also an insurance deductible, although a house insurance coverage costs and also insurance deductible is usually much more than a residence warranty's (home warranty claim). The primary differences between house warranties and home insurance policy are what they cover.

Excitement About Home Warranty Claim

One more difference between a home guarantee and residence insurance policy is that residence insurance coverage is generally required for house owners (if they have a home loan on their home) while a residence guarantee plan is not called for. A house warranty and also house insurance policy supply defense on various parts of a house, and with each other they can safeguard a house owner's budget plan from pricey repair services when they inevitably surface.If there is damage done to the framework of your house, the proprietor won't have to pay the high costs to fix it if they have house insurance policy. If the damages to the house's structure or homeowner's possessions was produced by a malfunctioning home appliances or systems, a residence service warranty can assist to cover the expensive repair services or replacement if the system or appliance has stopped working from typical damage.

They will collaborate to offer defense on every component of your house. If you're interested in buying a residence warranty for your house, take a look at Site's residence service warranty plans as well as prices below, or request why not try this out a quote for your home right here.

Getting My Home Warranty Claim To Work

In a best-seller's market where home buyers are waiving the home evaluation contingency, buying a home warranty could be a balm for worries about potential unknowns. To obtain one of the most out of a residence service warranty, it's vital to review the small print so you comprehend what's covered as well as just how the strategy works before signing up.The difference is that a house warranty covers a range of things instead than simply one. There are 3 conventional types of home guarantee plans.

:max_bytes(150000):strip_icc()/best-home-warranties-4777763_color-84f2d9cd3a924002ac1205fd676e3f1c.png)

Home Warranty Claim Fundamentals Explained

Building contractor guarantees typically do not cover home appliances, though in a brand name brand-new home with brand name brand-new appliances, manufacturers' warranties are likely still in play. If you're obtaining a house guarantee for a brand-new home either brand-new building and construction or a house that's new to you basics protection normally starts when you close., your house warranty firm may not cover it. Instead than counting solely on a service warranty, try to negotiate with the seller to either correct the concern or give you a credit to assist cover the cost of having it repaired.

You do not have to study as well as obtain recommendations to find a tradesperson each time you require something fixed. The other hand of that is that you'll obtain whomever the home service warranty company sends to do the examination and make the repair service. You can't select a specialist (or do the work on your own) and afterwards get repaid.

Home Warranty Claim for Beginners

For one, house owners insurance coverage is called for by loan providers in order to get a home mortgage, while a house guarantee is entirely optional. As stated above, a residence warranty covers the repair work and substitute of items as well as systems in your house.Your house owners insurance, on the various other hand, covers the unforeseen. It won't assist you replace your devices due to the fact that they got old, yet homeowners insurance policy could help you get brand-new appliances if your existing ones are harmed in a fire or flooding.

Just how a lot does a house service warranty expense? House guarantees normally set you back between $300 as well as $600 per year; the cost will certainly vary depending on the kind of plan you have.

Home Warranty Claim - An Overview

Report this wiki page